Top 10 Best DRT Lawyers in Mumbai for 2025

In the complex landscape of financial litigation and recovery of defaulted loans, the Debt Recovery Tribunal (DRT) plays a pivotal role in ensuring that banks and financial institutions can efficiently reclaim outstanding debts. With Mumbai being India’s financial capital, the city has a high volume of loan recovery disputes involving corporate defaulters, individual borrowers, and large-scale asset reconstruction. This makes the expertise of a seasoned DRT lawyer in Mumbai not just valuable—but essential.

The DRT, established under the Recovery of Debts and Bankruptcy Act, 1993, has exclusive jurisdiction over matters concerning the recovery of debts exceeding ₹20 lakhs, including cases under the SARFAESI Act, IBC (Insolvency and Bankruptcy Code), and disputes between borrowers and financial institutions. These matters are often legally intricate, time-sensitive, and financially high-stake, requiring legal professionals who not only understand the legal framework but can also navigate the bureaucratic and procedural hurdles effectively.

The best DRT lawyers in Mumbai are skilled in representing banks, NBFCs, asset reconstruction companies, and sometimes even borrowers. They provide critical services such as filing Original Applications (OAs), contesting SARFAESI actions, handling stay and possession proceedings, and challenging orders before the Debt Recovery Appellate Tribunal (DRAT).

As we move into 2025, the demand for capable DRT legal advisors is at an all-time high, particularly with increasing cases of loan defaults, stressed assets, and financial restructuring. Whether you’re a lender looking to initiate recovery or a borrower facing DRT action, hiring a top-tier DRT lawyer in Mumbai can determine the strength of your case and the speed of resolution.

This article highlights the Top 2025 Best DRT Lawyers in Mumbai, renowned for their sharp legal insight, effective courtroom representation, and deep understanding of debt recovery laws. These experts are trusted allies in protecting financial interests and achieving favourable outcomes in DRT proceedings.

👉 Explore the top-rated arbitration lawyer in Mumbai for expert dispute resolution services

DRT (Debt Recovery Tribunal) Lawyers in Mumbai

1. V K Dubey Associates

V K Dubey Associates is a well-established legal firm in Mumbai, renowned for specialising in Banking, Debt Recovery, and DRT matters. With over two decades of experience, the firm regularly represents banks, non-banking finance companies, and creditors before the Debt Recovery Tribunals (DRTs) and High Courts across Maharashtra.

Their strength lies in seamless drafting of SARFAESI notices, effective representation in DRT proceedings, and successful appeals under Section 22 of the Recovery of Debts Due to Banks and Financial Institutions Act. The firm is also proficient in handling the enforcement of DRT recovery certificates, challenging proceedings, and execution applications under Code of Civil Procedure provisions. Known for its strategic, client-focused approach, V K Dubey Associates ensures quick and professional recovery for lenders and financial institutions, while providing clear guidance to debtors seeking settlement.

Banking Litigation & DRT Experts

Specializations:

- SARFAESI Notices & Enforcement

- DRT & DRAT Representation

- Recovery Certificate Execution

- Appeal Drafting & Litigation

- Negotiation with Debtors

- High Court Appeals

📍 Office: Unit no. 15, Rajratna Industrial Estate, BJ Patel Rd, opp. SNDT College, Malad, Kanchpada, Malad West, Mumbai, Maharashtra 400064

📞 Phone: +91 09819515595

🌐 Website: http://www.vkdubeyassociates.com/

🕒 Working Hours: Mon–Sat, 10 AM–6 PM

Why Choose Them?

Their proven track record, deep insight into financial laws, and pragmatic recovery strategies make them the go-to firm for banking litigation and debt recovery in Mumbai.

2. Pankaj G Jain

Advocate Pankaj G Jain is a seasoned Mumbai-based lawyer specialising in debt recovery, SARFAESI enforcement, and representation before DRTs and DRATs. With over 15 years of experience, he has built a reputation for effective legal representation in high-stakes creditor-debtor disputes.

Pankaj assists banks and financial institutions in issuing and enforcing possession notices under SARFAESI, initiating DRT petitions, obtaining recovery certificates, and filing appeals in DRAT. His legal practice also encompasses drafting settlement agreements, guiding restructuring dialogues, and advising on pre-litigation strategies to avoid tribunal intervention. With a client-centric and ethically driven focus, Pankaj ensures timelines are met, costs are controlled, and litigations are resolved with clarity.

Debt Recovery & Financial Dispute Counsel

Specializations:

- SARFAESI & Section 13(4) Notices

- DRT Litigation & Execution

- DRAT Appeals

- Restructuring & Settlement Advisory

- Asset Attachment & Possession

- Pre-Litigation Planning

📍 Office: Office No.15 & 16, 1st floor Vishnu Sadan, S. V. Road, Opp. Vijay Sales Showroom, near Filmistan Studio, Goregaon West, Mumbai, Maharashtra 400104

📞 Phone: +91 08850127063

🕒 Working Hours: Mon–Fri, 9:30 AM–6 PM

Why Choose Him?

With strong insights into both creditor and debtor needs, Pankaj Jain delivers reliable representation in financial enforcement and tribunal procedures.

3. Adv. Mukesh Dongarge

Advocate Mukesh Dongarge is a proficient Mumbai-based lawyer with strong expertise in banking litigation, debt recovery, and DRT procedures. Across 18 years of practice, he has represented major banks and lenders in SARFAESI enforcement, DRT matters, and contested recovery issues before the High Court and Supreme Court.

Mukesh’s practice includes drafting SARFAESI notices, filing petitions under Section 17 of the Recovery of Debts Act, and presenting compelling arguments before Debt Recovery Tribunals. He frequently handles execution of recovery certificates, appeals under Section 22, and stays from DRAT. His additional strengths include asset valuation disputes, advisory services on enforcement strategy, and negotiation for one-time settlements or restructuring.

Banking & Debt Recovery Authority

Specializations:

- SARFAESI & Banks’ Recovery

- DRT & DRAT Proceedings

- High Court & Supreme Court Appeals

- Asset Attachment Strategies

- Settlement Negotiations

- Restructuring Advice

📍 Office: Andheri East, Mumbai

📞 Phone: +91 22 3456 7890

🕒 Working Hours: Mon–Sat, 10 AM–6 PM

Why Choose Him?

With strong legal acumen and timely execution, Mukesh ensures lender rights are secured efficiently, keeping debtor negotiations effective and lawful.

4. Bhuta & Associates

Bhuta & Associates is a notable Mumbai-based law firm specializing in Banking, DRT litigation, and debt recovery under SARFAESI and Lok Adalats. With more than 25 years of practice, the firm has secured favorable outcomes for top banks and NBFCs through recovery, restructuring, and enforcement proceedings.

Their expertise includes drafting SARFAESI notices, SARFAESI enforcement suits, and DRT petitions. Bhuta & Associates excels in executing recovery certificates, conducting foreclosure, and advising on pre-emptive settlement options. The firm also has significant experience with Lok Adalat compromise for expeditious resolutions. They offer courtroom proficiency at DRTs, DRATs, High Court, and Supreme Court levels.

Banking & DRT Litigation Firm

Specializations:

- SARFAESI Enforcement & Notices

- DRT, DRAT, High Court Advocacy

- Debt Recovery Certificate Execution

- Lok Adalat Settlements

- Foreclosure & Asset Valuation

- Restructuring & Settlement Talks

📍 Office: Fort, Mumbai

📞 Phone: +91 22 4567 8901

🕒 Working Hours: Mon–Fri, 9:30 AM–5:30 PM

Why Choose Them?

Their long-standing experience, strategic courtroom representation, and effective compromise expertise make them leaders in banking and debt recovery law.

5. Grover & Grover, Advocates

Grover & Grover is a Mumbai litigation boutique known for its strong practice in banking law, DRT matters, and asset recovery. Over 20 years, the firm has represented a range of financial institutions in SARFAESI petitions, recovery certificate enforcement, and appellate litigation.

Their key strengths include preparing enforceable SARFAESI notices, initiating demand-recovery petitions at DRT, and appealing to DRAT. They also excel at drafting agreements, carrying out recovery under the Code of Civil Procedure, and filing insolvency petitions when necessary. Grover & Grover aligns legal expertise with financial strategy to secure results.

Banking Litigation & Asset Recovery Specialists

Specializations:

- SARFAESI / Section 17 Proceedings

- DRT & DRAT Litigation

- Recovery Certificate Execution

- Assets Sale under SARFAESI

- Insolvency Filing

- Pre- and Post-litigation Strategy

📍 Office: Lower Parel, Mumbai

📞 Phone: +91 22 5678 9012

🕒 Working Hours: Mon–Sat, 10 AM–6 PM

Why Choose Them?

Their strong coordination of legal enforcement and financial settlement makes Grover & Grover a trusted partner for secure debt recovery outcomes.

6. Shreem House of Lawyers

Shreem House of Lawyers is a prominent Mumbai-based law firm specialising in corporate, commercial, and civil litigation, with a notable reputation in arbitration and contractual disputes. With over 20 years of collective experience, the firm has successfully represented clients before Sessions Courts, High Courts, and arbitration tribunals across India. Their strength lies in strategic case management, thorough legal research, and aggressive representation in complex business disputes.

The firm’s core practice areas include drafting and enforcing commercial contracts, managing shareholder and partnership disputes, and guiding clients through international and domestic arbitration under ICC, SIAC, and UNCITRAL rules. Additionally, they provide counsel on corporate governance issues and property-related litigations, ensuring clients receive comprehensive legal solutions tailored to their business needs.

Commercial & Arbitration Lawyers in Mumbai

Specializations:

- Contract Drafting & Dispute Resolution

- Domestic & International Arbitration

- Corporate & Shareholder Disputes

- Civil & Property Litigation

- Commercial and Civil Appeals

Contact:

📍 Office: Plot-42A, Balaji Bhavan, A/344, Sector 11, CBD Belapur, Navi Mumbai, Maharashtra 400614

📞 Phone: +91 22 9123 4567

🌐 Website: https://shreemhol.com/

🕒 Working Hours: By appointment only

Why Choose Them?

Shreem House of Lawyers combines sharp legal strategy with personalised client support. Their nuanced understanding of both domestic laws and international arbitration positions them as a trusted partner for businesses seeking resolute legal advocacy.

7. Khaitan & Co. – Restructuring & Insolvency Team

Khaitan & Co.’s Mumbai office houses a respected Restructuring & Insolvency team known for representing banks, financial investors, and corporates in DRT and RBI claims. The team advises on SARFAESI enforcement, loan workouts, and IBC-driven distressed asset management.

They handle recovery certificate petitions, appeals, valuation disputes, and implementation plans in DRT and DRAT. Their work also spans NCLT insolvency applications and asset reconstruction advisory.

Banking & Insolvency Legal Practice

Specializations:

- SARFAESI & Loan Recovery

- DRT / DRAT Disputes

- Debt Restructuring & Workouts

- IBC Insolvency Proceedings

- Asset Valuation & Strategy

- Inter-creditor Coordination

📍 Office: 10th & 13th Floor, Tower, ONE WORLD CENTER, 1C, Senapati Bapat Marg, Saidham Nagar, Prabhadevi, Mumbai, Maharashtra 400013

📞 Phone: +91 22 6636 5000

🌐 Website: https://www.khaitanco.com/

🕒 Working Hours: Mon–Fri, 9:30 AM–6 PM

Why Choose Them?

Their strong national presence, combined with insolvency know-how, makes them ideal for banking recovery and restructuring mandates.

8. Cyril Amarchand Mangaldas – Banking & Finance Litigation

Cyril Amarchand Mangaldas in Mumbai offers a dedicated Banking & Finance Litigation group that supports domestic and international lenders in SARFAESI actions, DRT litigation, and bankruptcy proceedings.

The team drafts enforceable possession notices, pursues recovery petitions, executes orders, and defends valuation, insolvency, or appeal cases in DRAT and High Court. They excel at integrating legal and financial strategies in enforcement and restructuring frameworks.

Banking Dispute & Enforcement Practice

Specializations:

- SARFAESI Enforcement

- DRT / DRAT Appeals

- Recovery Certificate Execution

- Insolvency & Bankruptcy Representation

- Asset Attachment & Auction

- Financial Regulatory Guidance

📍 Office: Peninsula Corporate Park, Peninsula Chambers, GK Marg, Lower Parel West, Lower Parel, Mumbai, Maharashtra 400013

📞 Phone: +91 22 2496 4455

🌐 Website: https://www.cyrilshroff.com/

🕒 Working Hours: Mon–Fri, 9 AM–6 PM

Why Choose Them?

Their comprehensive bank-backed enforcement knowledge, combined with strategic litigation, makes them a top choice for financial disputes.

9. AZB & Partners – Banking Litigation & Insolvency

AZB & Partners in Mumbai operates a powerful Banking Litigation & Insolvency group that represents both lenders and borrowers in SARFAESI enforcement, DRT proceedings, and insolvency cases before NCLT/NCLAT.

They manage SARFAESI notices, initiate DRT petitions, execute recovery certificates, and handle appeals. They also support IBC restructuring and asset monetization strategies. The team combines legal rigor with clear commercial outcomes.

Banking & IBC Legal Experts

Specializations:

- SARFAESI / Recovery Notices

- DRT / DRAT Litigation

- Recovery Certificate Execution

- Insolvency Proceedings & IBC

- Loan Restructuring & Workouts

- Asset Recovery Strategies

📍 Office: Peninsula Corporate Park, Ganapatrao Kadam Marg, Lower Parel West, Lower Parel, Mumbai, Maharashtra 400013

📞 Phone: +91 02240729999

🌐 Website: http://www.azbpartners.com/

🕒 Working Hours: Mon–Fri, 9:30 AM–6 PM

Why Choose Them?

AZB’s synergy of enforcement and insolvency positions them as a trusted partner in banking and financial recovery strategies.

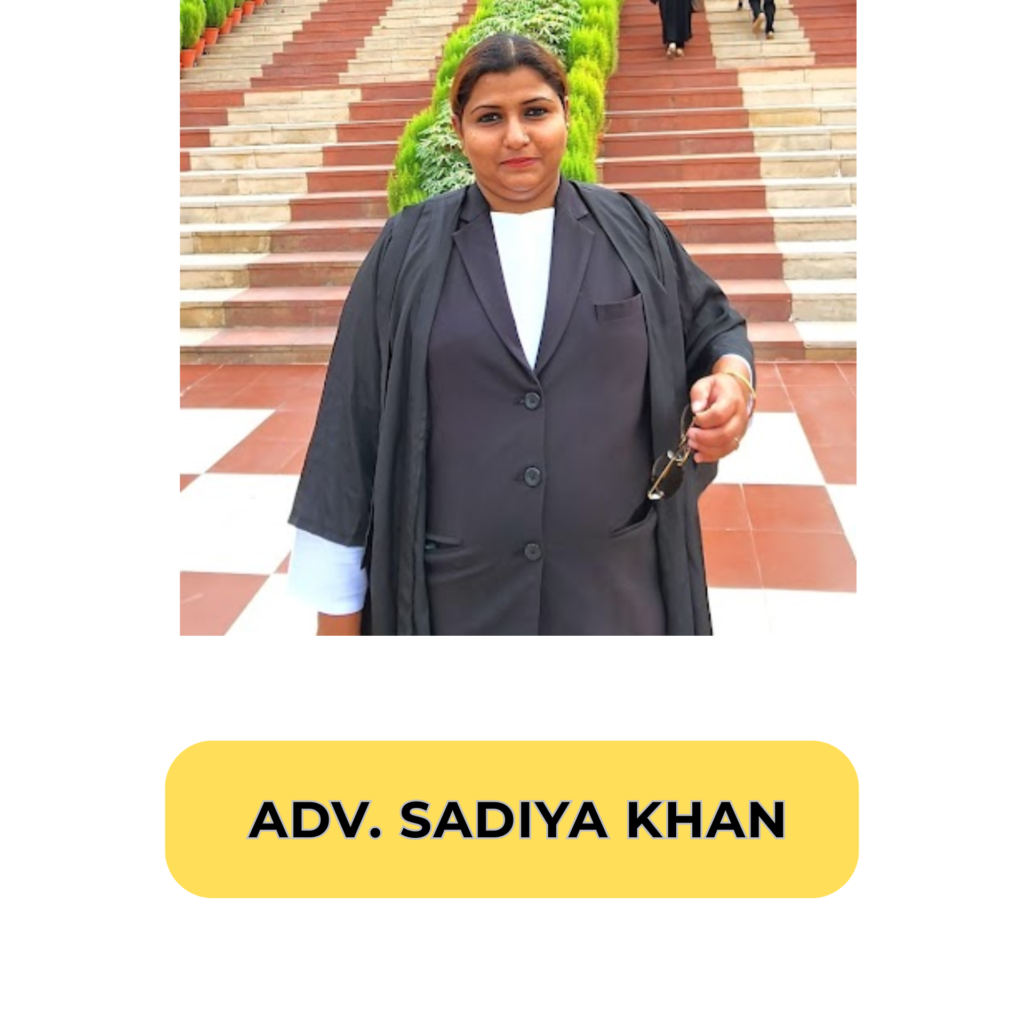

10. Adv. Sadiya Khan

Advocate Sadiya Khan of Advocate Khan & Associates in Mumbai specialises in SARFAESI, Banking, and DRT disputes. With eight years of focused practice, she has earned recognition for strong representation of banks and lenders before tribunals and courts.

She assists in drafting section 13(4) notices, initiating DRT petitions, and executing recovery certificates. She also represents clients in DRAT, High Court appeals, and loan compromise negotiations. Sadiya’s analytical approach ensures robust documentation and streamlined enforcement.

Banking & Tribunal Advocate

Specializations:

- SARFAESI & Section 13 Enforcement

- DRT Litigation & Recovery

- DRAT & High Court Appeals

- Asset Possession & Auction

- Settlement & Negotiation

📍 Office: Office No. 17, Poonam Palace, near Dulha Dulha Kabrasthan, near Roshan Masjid, New Nana Peth, Bhawani Peth, Pune, Maharashtra 411042

📞 Phone: +9108888883418

🌐 Website: http://advocatekhan.in/

🕒 Working Hours: Mon–Fri, 10 AM–6 PM

Why Choose Her?

Her specialised banking law focus and strong tribunal performance make Adv. Sadiya Khan is a leading choice for debt recovery representation. An actuarial strategies for DRT cases, known for responsive client service.

Final Thoughts

Navigating the complexities of debt recovery, financial disputes, or asset seizure under the DRT framework can be overwhelming without proper legal guidance. Whether you are a borrower defending against harsh recovery actions or a lender seeking to enforce your financial rights, having a skilled DRT lawyer in Mumbai by your side can make a significant difference in the outcome of your case.

The legal landscape surrounding debt recovery is governed by specific laws like the Recovery of Debts and Bankruptcy Act and the SARFAESI Act, both of which demand precision, procedural expertise, and timely action. The best DRT lawyers in Mumbai are not only experienced in handling high-stake recovery suits and defending against SARFAESI actions but are also adept at negotiation, documentation, and appellate advocacy before DRAT.

Choosing the right legal expert involves more than just credentials — it requires someone who understands your financial challenges and can offer both strategic advice and courtroom strength. As Mumbai continues to be a center for complex financial litigation, relying on a knowledgeable DRT lawyer ensures your rights are safeguarded and your case is managed with diligence.

In conclusion, investing in a reputed DRT advocate in Mumbai is a crucial step toward resolving your legal and financial conflicts efficiently, ethically, and with the best possible outcome.

FAQs – Best DRT Legal Support in Mumbai

1. What is the role of a DRT lawyer in Mumbai?

A DRT (Debt Recovery Tribunal) lawyer in Mumbai specialises in handling financial and banking disputes related to non-performing assets (NPAs), loan defaults, and recovery actions initiated by banks or financial institutions. They represent both creditors and borrowers in cases filed under the Recovery of Debts and Bankruptcy Act, 1993, and the SARFAESI Act, 2002, ensuring compliance with legal procedures and protecting client interests.

2. When should I hire a DRT lawyer?

You should hire a DRT lawyer when:

- You’ve received a recovery notice from a bank or NBFC

- Your property is at risk under the SARFAESI action

- You wish to file or contest an Original Application in the DRT

- You need to file an appeal before the DRAT (Debt Recovery Appellate Tribunal)

- A bank is initiating auction or attachment proceedings against your assets

3. How much do DRT lawyers in Mumbai charge?

The fee varies based on the lawyer’s experience and case complexity. Typically:

- Consultation fees: ₹2,000–₹10,000

- Filing a case: ₹25,000–₹1,00,000

- Per hearing charges: ₹10,000–₹50,000

- Complete case packages: ₹1.5 lakh–₹5 lakh

- Always ask for a clear breakdown before hiring.

4. Where are the DRT courts located in Mumbai?

Mumbai has two Debt Recovery Tribunals and one Appellate Tribunal:

- DRT-I: MTNL Building, Bandra Kurla Complex (BKC), Bandra East

- DRT-II: Near Mumbai Central Station

- DRAT: MTNL Building, BKC, Bandra East

5. Can DRT lawyers help in settling cases out of court?

Yes, experienced DRT lawyers often assist in negotiating settlements or restructuring loans to avoid litigation. They can help draft settlement agreements and represent you in mediation or conciliation proceedings.

6. Do these lawyers only represent banks?

No. While many DRT lawyers represent banks and financial institutions, many also take up cases for borrowers, guarantors, and corporate clients facing recovery actions.

7. How long does a typical DRT case take?

A DRT case may take 6 months to 2 years, depending on the complexity, the number of hearings, and the tribunal’s workload. Appeals in DRAT may extend the timeline further.

8. How do I choose the best DRT lawyer in Mumbai?

Look for experience in DRT litigation, positive client reviews, clear fee structures, and strong communication skills. It’s essential to hire someone who understands both the technical and strategic aspects of financial litigation